What Is An Angel Network Or Angel Group?

An angel group or network comprises investors who pool their resources to invest in new businesses in an organised manner.

How Do Angel Networks Work?

Angel groups make larger investments than solo angel investors. The selected angels are required to contribute a certain amount to create a pool of investment per deal. The member angels come together to assess the pitches of founders and make investment decisions based on them.

How Many Angel Networks Does India Have?

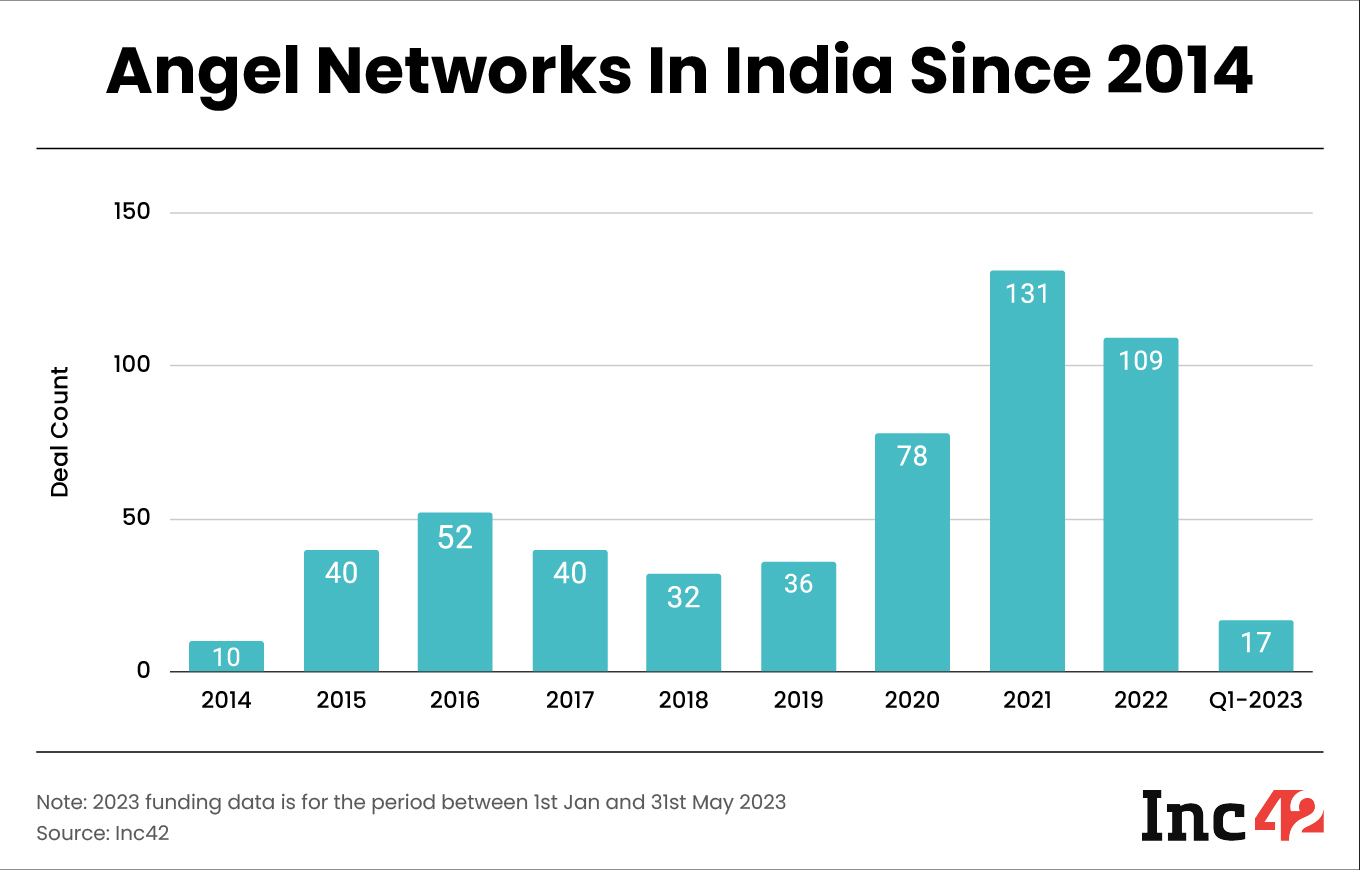

Angel networks, including angel networking platforms and angel syndicates, have funded more than 470 startups since 2014. There are more than 125 active angel networks, including syndicates and platforms, in India. Additionally, 545 deals have been recorded between 2014 and Q1 2023 (see the graph below).

Here’s the list of the most active angel networks in India.

What Are The Benefits Of Joining An Angel Network?

- Joining angel networks gives investors, especially those new to the game, an opportunity to connect with like-minded people. They can also tap the knowledge and insights that seasoned angel investors in the group hold.

- By joining an angel network, individual investors get access to a team of experts appointed for the due diligence process. These experts make the due diligence more thorough.

- Solo investors get direct access to a number of portfolio startups, big and small, that can help them diversify their investment portfolio.

- Investing in early stage startups as a solo investor is a risky affair. However, joining an angel group helps minimise this risk factor as it will be shared with other investors.

- Members of the angel network have access to global entrepreneurs and business professionals if the group invests in global businesses. These connections can be leveraged in the future.

- Individual investors get an opportunity to participate in larger funding rounds that would not be possible in their capacity as solo angel investors.

- Angel networks allow their member investors flexible participation. This means that the network recognises the investment capacity of each of its member investors and lets them make the decision based on it in a funding pool.

What Are The Examples Of Top Angel Networks In India?

List of some of the top angel networks in the country:

- Ah! Ventures

- AngelList India

- The Bengaluru Angels

- Chandigarh Angel Network

- Hyderabad Angels

- Indian Angel Network

- LetsVenture

- Mumbai Angels

- Venture Catalysts

What Are The Criteria For Angel Investors To Join An Angel Network?

In the Indian context, an angel investor must have net tangible assets of at least INR 2 Cr, excluding the value of the principal residence and satisfy one of the following conditions:

- Have early stage investment experience

- Have experience as a serial entrepreneur

- Should be a senior management professional with at least 10 years of experience.

Besides, a body corporate with a net worth of at least INR 10 Cr or an alternative investment fund (AIF) registered under SEBI AIF Regulations, 2012 or a venture capital fund (VCF) registered under the SEBI (Venture Capital Funds) Regulations, 1996 are also qualified to join an angel network.

How Can Startups Pitch To Angel Networks For Funding?

To begin with, startups must thoroughly research to identify a suitable network from which they wish to secure funding. Once the list has been narrowed down, they can approach the members of the network through LinkedIn or visit their respective websites.

In fact, some angel network platforms offer forms on their websites for startups to fill out their briefs. Startups may also have the option to become members of these platforms, adhering to the specific guidelines set by the networks.

Once a startup meets the necessary requirements, a member of the network team will respond and arrange a meeting to discuss the next steps. During this meeting, decisions regarding a demo day can be made.

Additionally, angel networks actively seek out investment opportunities and reach out to startups, offering assistance in raising funding.

How Much Does An Angel Investor Need To Invest To Become A Member Of An Angel Network?

As per SEBI regulations, angel funds can accept, up to a maximum period of 3 years, an investment of not less than INR 25 Lakh from an angel investor.

What Risks Are Associated With Investing In A Startup Through An Angel Network?

- Investing in early stage startups involves the risk of total or partial loss of capital for all the member investors of an angel network.

- Management of the portfolio companies could mislead the investors by providing inaccurate information like false financials to attract investment.

- If portfolio startups violate laws, such as those for labour and environment, they could become legal liabilities for the investors.

- Intellectual property risks such as patent or trademark conflicts could potentially become financial liabilities due to costly legal disputes.

- Portfolio startups’ failures or involvement in controversial industries can harm an investor’s public image and risk their reputation. This could potentially impact future investment opportunities.

What Are The Challenges For Angel Networks?

Industry experts believe that angel networks are facing challenges due to a ruling by SEBI, which requires angel networks to invest through angel funds under AIF category I.

Besides, managing a group of angels poses significant challenges. Angel networks require substantial resources to handle a large team effectively. As a result, members of these networks often bear hefty management fees. This can impact the overall sustainability of such networks.

What Is The Role Of Angel Networks In The Startup Ecosystem?

Angel networks play an important role in the startup ecosystem by providing early stage funding to startups. Angel networks connect startups with investors who are willing to invest capital that may be difficult to obtain through traditional channels.

Angel networks often go beyond capital investment. They also provide industry expertise, mentorship and guidance to startups, helping them navigate challenges and make informed decisions.

Given that angel networks are a group of multiple angel investors, receiving funding from an angel network increases the credibility of a startup. This makes it easier for the startup to attract investments at a later stage.

Additionally, angel networks facilitate networking opportunities and contribute to the development of the local startup ecosystem.

As per Mumbai-based incubator Venture Catalysts, the number of angel investments in the country is on the rise, which has made it easier for startups to raise seed funding. It attributes this increase to the shift in the mindset of investors. Angel investors don’t view startup investment as a risky affair but as a new asset class.